Health Insurance vs. Life Insurance – Full Comparison (2025 Complete Guide)

Which one do you really need, when, and why?

Introduction

Many people buy insurance—but most don’t fully understand it.

One of the biggest confusions in personal finance is between Health Insurance and Life Insurance.

They sound similar, but in reality, they serve completely different purposes.

If you are asking:

- Which is more important in 2025?

- Do I need health insurance, life insurance, or both?

- Can one replace the other?

- Which insurance protects my family better?

- Which one gives more financial value?

This complete comparison guide will answer everything clearly, honestly, and practically—without jargon.

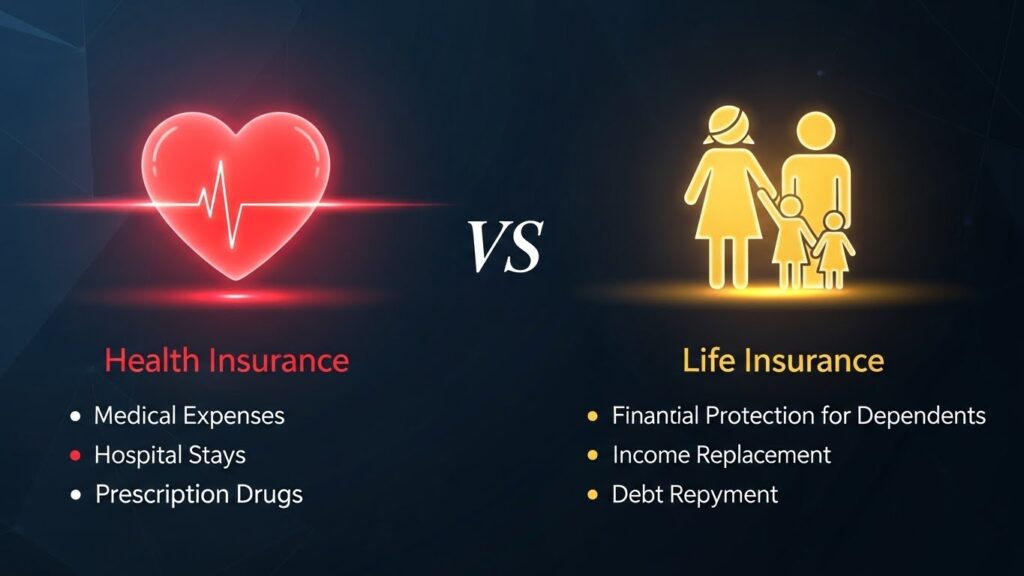

What Is Health Insurance? (Simple Explanation)

Health insurance covers your medical expenses when you get sick, injured, or hospitalized.

It pays for:

- Hospital bills

- Surgeries

- Doctor consultations

- Medicines

- Diagnostic tests

- Emergency treatment

- ICU charges

- Ambulance services

- Pre & post-hospitalization care

Purpose of Health Insurance

👉 To protect your savings and income from rising medical costs.

In 2025, even a small hospitalization can cost a lot. Health insurance prevents sudden financial stress.

What Is Life Insurance? (Simple Explanation)

Life insurance pays money to your family or dependents after your death.

It helps cover:

- Daily household expenses

- Children’s education

- Home loan or personal loan repayment

- Funeral expenses

- Long-term family security

Purpose of Life Insurance

👉 To protect your family’s financial future if you are no longer there to earn.

Health Insurance vs. Life Insurance – Quick Comparison Table

| Feature | Health Insurance | Life Insurance |

|---|---|---|

| Covers | Medical & hospital expenses | Death of policyholder |

| Who gets benefit | You | Your family |

| When it pays | During illness or accident | After death |

| Payout type | Cashless / reimbursement | Lump-sum payout |

| Duration | 1 year (renewable) | 10–40 years |

| Main goal | Protect savings | Replace income |

| Mandatory? | Highly recommended | Essential if you have dependents |

Key Differences Explained in Detail

1. Coverage Difference

Health Insurance Covers:

✔ Illness

✔ Accidents

✔ Hospital stays

✔ Surgeries

✔ Medical emergencies

Life Insurance Covers:

✔ Death

✔ Accidental death (optional)

✔ Terminal illness (optional add-on)

📌 Health insurance works while you are alive

📌 Life insurance works after your death

2. Financial Protection Type

- Health Insurance → Short-term financial protection

- Life Insurance → Long-term family protection

Both protect different risks.

3. Who Should Buy Health Insurance?

Everyone. No exceptions.

Especially:

- Young professionals

- Students

- Families

- Self-employed individuals

- Senior citizens

- People with medical history

Even healthy people need health insurance because medical emergencies are unpredictable.

4. Who Should Buy Life Insurance?

You should buy life insurance if:

- Someone depends on your income

- You have children

- You are married

- You have loans

- You want to secure your family’s future

If no one depends on you financially, life insurance is optional—but still recommended for future planning.

5. Premium Cost Comparison

Health Insurance Premium Depends On:

- Age

- Medical history

- Coverage amount

- Add-ons

- City / hospital network

Life Insurance Premium Depends On:

- Age

- Health condition

- Smoking habits

- Policy duration

- Coverage amount

💡 Buying early = much cheaper premiums for both.

6. Payout Structure

Health Insurance:

- Pays hospital bills directly (cashless)

- Or reimburses expenses

Life Insurance:

- Pays a large lump sum to nominee

- Money can be used freely

7. Duration & Renewal

| Insurance | Duration |

|---|---|

| Health Insurance | Renewed every year |

| Life Insurance | Long-term contract |

Life insurance premiums remain fixed once locked.

8. Tax Benefits (High-CPM Factor)

Both offer tax benefits (rules vary by country):

Health Insurance:

✔ Tax deduction on premium

✔ Medical expense benefits

Life Insurance:

✔ Tax deduction on premium

✔ Tax-free death benefit

Insurance + tax = very high CPM niche.

Types of Health Insurance (2025)

- Individual Health Insurance

- Family Floater Plan

- Senior Citizen Health Plan

- Critical Illness Insurance

- Top-Up & Super Top-Up Plans

- Employer Group Health Insurance

Types of Life Insurance (2025)

- Term Life Insurance (BEST choice)

- Whole Life Insurance

- Endowment Plans

- ULIPs (Insurance + Investment)

📌 Term insurance gives the highest coverage at lowest cost.

Health Insurance vs. Life Insurance: Which One Is More Important?

If you ask honestly:

✔ Health Insurance is immediately important

✔ Life Insurance is critically important for dependents

Priority Order:

1️⃣ Health Insurance

2️⃣ Life Insurance

But ideally, you should have both.

Can Health Insurance Replace Life Insurance?

❌ NO

Health insurance:

- Stops medical bills

- Does NOT support family after death

Life insurance:

- Supports family after death

- Does NOT pay medical bills

They are not substitutes.

Best Strategy for 2025 (Expert Advice)

If you are single & young:

✔ Health insurance

✔ Small term life insurance

If you are married:

✔ Family health insurance

✔ Large term life insurance

If you have kids:

✔ High-coverage health insurance

✔ Term life insurance = 10–15× annual income

Common Myths (Truth Revealed)

❌ “I’m young, I don’t need health insurance”

✔ Young people get sick too—and premiums are cheaper.

❌ “Employer insurance is enough”

✔ It ends when you change or lose job.

❌ “Life insurance is only for old people”

✔ Buying early saves massive money.

Final Verdict: Health Insurance vs. Life Insurance

🟢 Health Insurance:

Protects your health & savings

🔵 Life Insurance:

Protects your family & future

👉 One protects YOU

👉 One protects your FAMILY

For complete financial safety in 2025, you need both.